This resource is provided by ACSA Partner4Purpose AALRR.

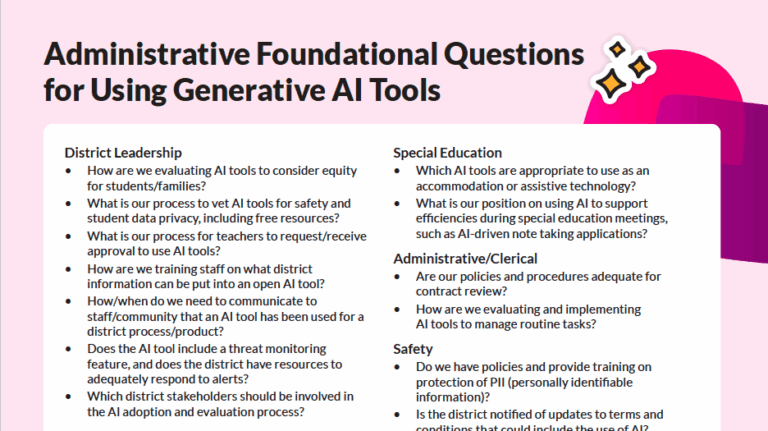

The State Allocation Board (“SAB”) has approved its biannual adjustment to Level 1 Statutory School Fees (also commonly referred to as “Developer Fees”) collected by school districts throughout the State. Pursuant to Education Code section 17620, a governing board of any school district is authorized to levy a fee against any construction within its boundaries to fund the construction or reconstruction of school facilities. The Level 1 Statutory School Fee is adjusted every two years per Government Code Section 65995. The rise of costs in construction (RS Means cost index) resulted in an unprecedented 17.45% increase in the maximum Level 1 Statutory School Fee that unified school districts may collect. For those school districts that are not unified (elementary and high school districts), the Level 1 Statutory School Fee is proportionately shared among the elementary and high school districts pursuant to a fee sharing agreement.

For residential construction, the maximum Level 1 Statutory School Fee increased from $4.08 per square foot to $4.79 per square foot. For commercial/industrial construction, the maximum Level 1 Statutory School Fee increased from $0.66 per square foot to $0.78 per square foot.

School districts remain obligated to justify the Level 1 Statutory School Fee through the consideration and adoption of a report commonly known as a Fee Justification Report. School districts should be aware of the statutory requirements, including, but not limited to, a public hearing and publication of a notice, when preparing for the adoption of its Fee Justification Report.

With the significant increase to the maximum Level 1 Statutory School Fee, we anticipate that developers and construction associations will closely review school districts’ Fee Justification Reports this year. We expect an increase in public comments on the substance of the Fee Justification Reports. Developers will carefully review the procedures taken by a school district when adopting its Fee Justification Report. We caution school districts to stay involved and knowledgeable about the analysis contained in and the process to adopt their Fee Justification Reports.

Additionally, school districts should be aware of Assembly Bill 602 (Grayson). AB 602 requires a “local agency” adopting an impact fee nexus study to follow a new statutory scheme. The new procedure to adopt an impact fee nexus study pursuant to AB 602 includes, but is not limited to, (1) identifying the existing level and new level of service in the report; (2) calculating a fee on a housing development project that is proportionate to the square footage of the proposed units; (3) posting fee schedules on a local agency’s website; and (4) requiring a 30-day notice period before a public hearing to consider the adoption of the study.

Upon review of the Legislative Committee Reports for AB 602, it appears that the Legislature intended to exempt school fees from the new statutory procedures required by AB 602. The Legislative Committee Reports explicitly recognize that school fees are governed by other statutory rules with more specific limitations when adopting school fees. We understand, however, that AB 602 contains some ambiguity in the manner it was drafted. We encourage school districts to discuss the applicability of AB 602 with legal counsel before considering the increase to Level 1 Statutory School Fees.

This AALRR publication is intended for informational purposes only and should not be relied upon in reaching a conclusion in a particular area of law. Applicability of the legal principles discussed may differ substantially in individual situations. Receipt of this or any other AALRR publication does not create an attorney-client relationship. The Firm is not responsible for inadvertent errors that may occur in the publishing process.

© 2022 Atkinson, Andelson, Loya, Ruud & Romo